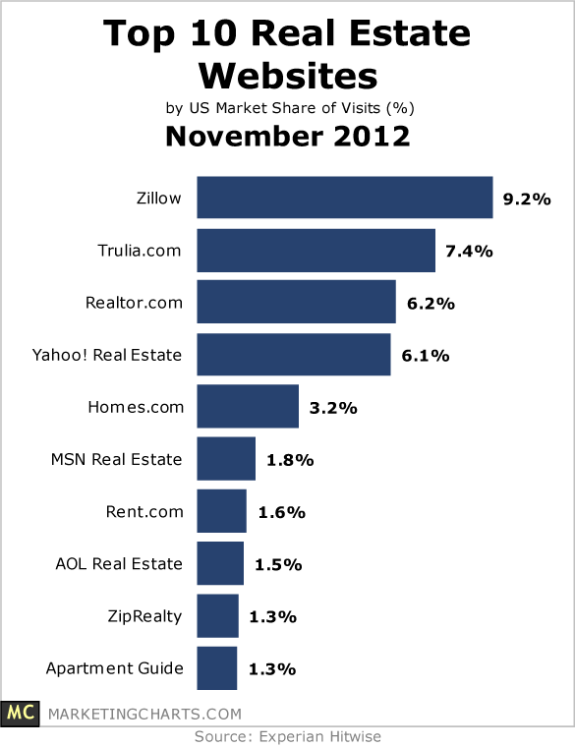

If the stock market is any guide, real estate continues a strong recovery that began in 2011. Small cap housing real estate investment trusts have been up 20-35% this year alone as new capital flows into the fund. Zacks gets credit for calling this trend last summer on a product called ROOF. The IndexIQ detail is here: (http://www.indexiq.com/indexes/real-estate-indexes.html). What the chart below shows is that Zillow and Trulia have become destination sites for real estate sellers and buyers despite some issues regarding lack of local market awareness and scarcity knowledge. If you don’t over-intellectualize their valuation estimates, they do collect a lot of data and it complements what you find on MLS sites.

Is ROOF a Better Real Estate ETF?

by Zacks ETF Research, August 23, 2012 – ROOF IYR VNQ

The real estate segment has been a huge winner this year despite the ongoing chaos in the European market and the uncertain U.S. growth outlook. This is largely thanks to strengthening commercial real estate fundamentals, recovering housing sentiments, high dividend payouts and low interest rates are making securities in this segment attractive at present. Investors looking to cycle their exposure back to the market might consider real estate ETFs for their exposure. These have often outperformed the other traditional safe havens such as bonds and gold, suggesting that they have also become a solid bet as of late (read: Real Estate ETFs: Unexpected Safe Haven). Though many U.S. real estate ETFs have gained more than 10% so far this year, the small cap IQ US Real Estate Small Cap ETF ( ROOF ) has outpaced its large counterparts in the space such as Vanguard REIT ETF ( VNQ – ETF report ) and iShares Dow Jones US Real Estate Index Fund ( IYR ) by at least 700 bps in the year to date time frame, meaning that small caps are leading the charge back higher. As the real estate market recovers, small cap real estate ETFs are poised to benefit enormously from the current market environment, implying that they could continue to outperform heir large cap counterparts as the year progresses. This is because small caps are less vulnerable to global trends, tend to do better on average in rising markets, and can potentially offer a different—and hopefully better—sector mix than their large cap peers in changing markets (read: Small Cap Real Estate ETFs: Crushing The Competition).